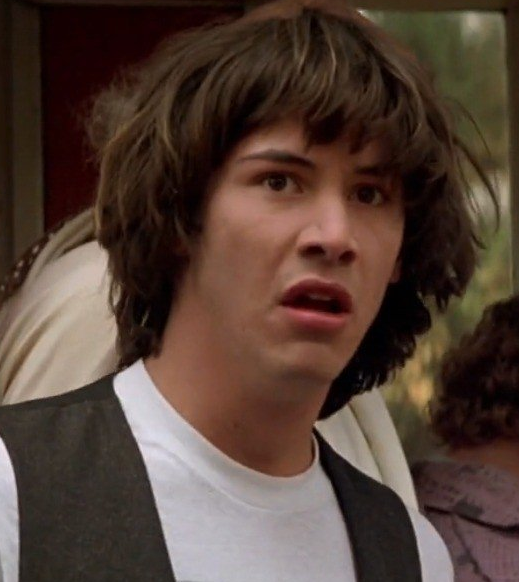

I’ll take greedy corporations for 500!

But but I was told that increase in Russian egg prices were unique and a sign of a collapsing empire!

Worth a read https://pluralistic.net/2023/01/23/cant-make-an-omelet/#keep-calm-and-crack-on

At the same time the last egg price spike was happening in the US, one of the largest market share producers just so happened to have a 65% YoY profit increase. Go figure.

Yep. No reason not to think it isn’t just corporate greed again.

(from the article)

In absolutely unrelated news, eggs are suddenly incredibly expensive. A dozen “conventional” eggs are currently averaging $2.88, which is double what they cost a year ago. Supposedly, this is caused by a supply chain shock (an avian flu outbreak).

But – and this will shock you, I know – the single company that dominates the US egg industry, Cal-Maine Food (AKA CALM – ugh) is making record profits. Their Q3/22 net was up 65% from the year before. Cal-Maine’s Q4-22 sales were up record-smashing 110% – $801.7m:

Shit is infuriating, Americans should be tarring and feathering these people

because dem chickens is organized

Aye, dem in a chicken coop

tl;dr: prices =/= costs, price is cost + what the market will bear.

I have an anarchocapitalist friend who is convinced to his core that prices are driven by costs, which any economist will tell you is not the case. He believes, therefore, that lowering wages, lowering taxes, and lowering costs on businesses in a truly fair and free market will make things more affordable. And maybe he’d be right if we had a spherical cow kind of economy, with perfect competition and elastic demand for everything, but that’s not we have, and most sane economists will agree that that’s not the way things are.

In reality, any MBA can tell you that prices are independent of costs insofar as you just have to be bringing in more money than is going out. The role of a corporation is to make money (to make a return on investment), and this has been especially true since the Friedman doctrine (tl;dr: the sole moral obligation of a company is to its shareholders) has been the dominant school of business thought. So if your costs are a dime and you can sell for a dime and a penny, then you sell for a dime and a penny. If you costs are a dime and you can sell for a dollar, then you sell for a dollar. If your costs go down to a penny and you can still sell just the same for a dollar, you don’t lower your prices nine cents. The only force that drives down prices is competition, because in a spherical cow economy, if your costs are fifty cents, you can’t sell too much above that or your competitors will undercut you and murder your profits, so you have to be very careful about price increases and constantly seek new means of cutting costs. In reality, there’s very little competition and demand is highly inelastic for a lot of important things like housing and healthcare, so it’s pretty easy for prices to just go up until so many people get priced out that the price increases yield a negative return. I think we’re already there, and have been for a while, but not to worry, we came up with a solution: debt and subscriptions/payment plans.

Few people can swing $40-80,000 for a college education, you might have to settle for lower prices to get the volume you need, but if you say “not to worry, we’ll just have you pay us back later,” you can suddenly charge a lot more and still get a high volume. If you charged $100,000 up front for lifesaving care, people would just die because nobody has that laying around, but if you just make it debt, well, hey, nbd, charge whatever the fuck you want and worry about it later. You can’t sell a $60,000 truck, or a $1500 phone, but you can sell a $600/mo truck (apparently, as much as that amazes me) or $35/mo phone. We’re seeing this same phenomenon at work with the latest push towardss 40-year mortgages amid continuously insane housing prices.

So, to answer your question, it’s going to keep getting worse as long as production is highly centralized, as it is continuing to be, because investors need their profits. Who’s got odds that we’ll see an egg subscription plan before the year end?

The answer won’t shock you.